Public vs Private Insurance in Germany: The Ultimate Guide for Expats

Sep 24, 2024

Table of content

Public vs Private Insurance in Germany:

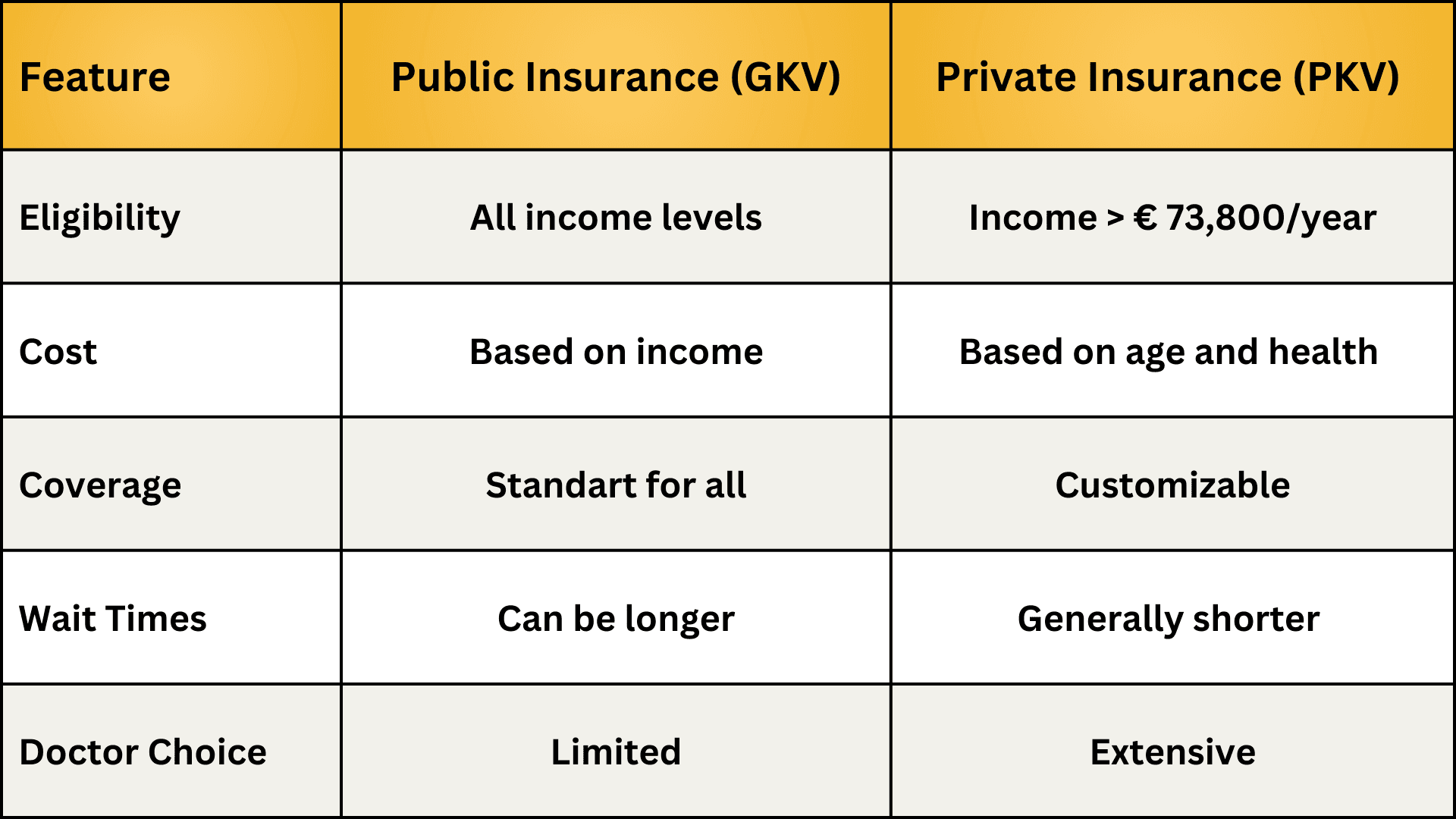

Germany boasts a dual healthcare system, renowned for its quality and efficiency. As an expat, it's essential to grasp the key differences between public (GKV) and private (PKV) health insurance options.

Eligibility Criteria: Who Can Choose What?

Public Insurance (GKV): Mandatory for employees earning less than €73,800 per year (as of 2024)

Private Insurance (PKV): Available for:

High earners (above €73,800 annually)

Self-employed individuals

Civil servants

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

Advantages of Private Health Insurance for Expats

For high-earning expats in Germany, private health insurance (PKV) offers several compelling benefits:

Shorter Waiting Times:

GPs: 2,5 days (PKV) vs 6 days (GKV)

Specialists: Days (PKV) vs Weeks (GKV)

Comprehensive Coverage:

Access to alternative treatments

Cutting-edge medical technologies

Customizable plans

Potential Cost Savings:

Fixed premiums not tied to income

Possible annual savings up to €4,123 for high earners

Global Coverage:

Ideal for frequent international travelers

Peace of mind with worldwide protection

Comparing Costs: Public vs Private Insurance for High Earners

Public Insurance (GKV):

Premium: 16,9% of gross salary

Monthly cost: Approximately €1200 (split 50/50 between employee and employer)

Private Insurance (PKV):

Fixed premiums based on age and health status

Basic plans: €225 to €390 per month

Potential for significant savings for young, healthy, high-earning expats

Long-Term Considerations:

"Aging reserves" help stabilize long-term costs

Deductible options and bonus programs can reduce premiums

No claim bonuses

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

Making the Switch: From Public to Private Insurance

Step-by-Step Guide:

Confirm eligibility (annual income over €73,800)

Research and compare private plans

Formally cancel public insurance

Apply for private coverage (2 months before desired start date)

Verify new insurance activation before public plan ends

Required Documentation:

Proof of income (above €73,800/year)

Identification (passport)

Health questionnaire

Visa/residency documentation

Finding the Right Private Insurance Plan with myhealthcarebroker

At myhealthcarebroker, we specialize in helping expats aged 24-38 find the perfect private health insurance plan in Germany.

Our Services:

Personalized support from experienced brokers

Access to a wide range of tailored insurance plans

Simplified comparison and selection process

Ongoing guidance and advocacy

Why Choose myhealthcarebroker?

Expertise in expat health insurance needs

Potential annual savings up to €4,250

Comprehensive coverage tailored to your lifestyle

Peace of mind with english speaking concierge

Conclusion: Making an Informed Decision

Choosing between public and private health insurance in Germany is a significant decision that impacts your healthcare experience and finances. By understanding the German healthcare system and considering your individual needs, you can make an informed choice that provides the best coverage for your situation.

Still unsure about choosing between public and private health insurance in Germany? Contact our expert team at myhealthcarebroker for personalized advice.

Remember: To be eligible for private health insurance in Germany, you must have an gross annual income of at least €73,800.

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.